Overview

Maritime security in the Gulf of Aden and Red Sea has been significantly degraded since the onset of the Israel-Hamas conflict in October 2023, with Iran-backed Houthi forces displaying continued intent and capability to target commercial shipping. Houthi attacks show no sign of abating despite the deployment of a US-led maritime coalition intended to support freedom of navigation in the Gulf of Aden and southern Red Sea.

Gulf of Aden

The Israel-Hamas conflict that followed the 7 October attacks has developed into a globally significant issue, with the involvement of Iran-backed militant groups having a destabilising effect and increasing the risk of escalation in the Middle East region. These groups have frequently conducted attacks against Israeli interests – and those of their allies – in support of Hamas, including by targeting Israeli territory and US military bases in the region, however, attacks against commercial shipping have provoked particularly widespread concern.

The threat to shipping stems from the Yemen-based Houthis, whose forces seized the country’s capital in 2014, sparking a conflict that drew a response from a Saudi-led coalition in 2015 in support of the internationally recognised Yemeni government. Despite Iranian officials claiming to have only offered “advisory and spiritual support”1, the Houthis were observed to rapidly increase their capabilities during the conflict, with missile and drone attacks against Saudi Arabia and other Gulf States underscoring their ability to project force well beyond Yemen’s borders2. The group also proved to be extremely resilient, remaining capable of conducting such attacks despite being frequently targeted by the Saudi-led coalition, with only a ceasefire deal agreed in 2022 being successful in easing hostilities for a substantial period of time3.

Following the incident on October 7, the Houthis said they would provide Hamas with military support, which has included the use of drones and missiles4. The Houthis initially sought to leverage their long-range strike capabilities to target Israeli territory – with limited effect – and then subsequently announced they would continue to attack Israel but would also target Israeli-linked ships in the Red Sea and Bab al-Mandeb Strait5.

Following this statement of intent, the Houthis boarded and seized the part-Israeli-owned car-carrier Galaxy Leader on 19 November 2023 – the crew are still held in Yemen6. The group also began to target commercial shipping, including with weaponised drones, and anti-shipping cruise and ballistic missiles. At least 45 attacks (as of 17 November) have been conducted against shipping in the Red Sea and Gulf of Aden since the Houthi campaign began – with several other incidents taking place in the Arabian Sea suspected of being conducted by other players (see Figure 1). Although no vessels have been sunk or loss of life caused, the Houthi attacks have caused serious concern for operators, especially since the group has been observed to expand targeting to include US- and UK-linked vessels in reprisal for airstrikes in January.

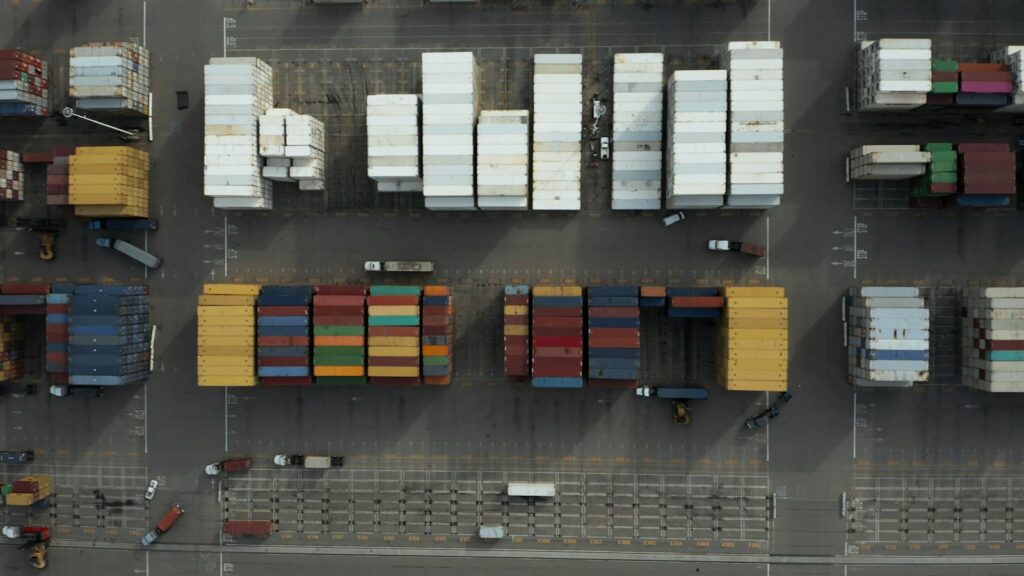

Houthi attacks have had a significant impact on global maritime trade, with most global container lines carrying cargo between Asia and Europe avoiding the Gulf of Aden/Red Sea/Suez Canal route by rerouting via the southern tip of Africa7, with global shipping already significantly disrupted by the Panama Canal drought8. Illustrating the wide-ranging impact, both the chemical and automotive industries have reported business disruption, with German chemical manufacturers warning of interruption, and European Tesla and Volvo plants having to suspend production due to component shortages9. In addition to delays and costs due to factors including fuel and other additional operational considerations, marine insurance costs have reportedly risen from around 0.1% of the value of the loaded ship to approximately 0.5%10, while vessels using the Suez route must also pay a risk premium of typically USD $30-100 per container11.

Due to their attacks against shipping, the Houthis have faced international condemnation. In an effort to deter further attacks and degrade the Houthis’ capabilities, the UK and the US (with support from Australia, Bahrain, Canada, and Netherlands) under Operation Prosperity Guardian launched airstrikes in Yemen on 11 January, 22 January, and 1 February12. Targets included missile launchers, air defence systems, radars, and weapons storage facilities. The operation also involves a maritime taskforce, intended to ensure freedom of navigation through the region, including by intercepting Houthi missiles and drones13. However, the level of deterrence brought by the airstrikes and ability of naval units to negate the threat of attacks remains doubtful, as the British-linked tanker Marlin Luanda was struck by a Houthi anti-ship missile on 27 January some 110km southeast of Aden14.

Current Situation

At the time of writing there is little to suggest that the threat posed by Houthi attacks will abate in the immediate term, with the Houthis both claiming new attacks and asserting that they will continue on 1 February.15 Although the Houthis claim to be focusing their attacks on Israeli, as well and UK and US-linked vessels, the often complicated nature of defining a vessel’s national affiliation – as factors such as ownership, flag, crew nationality, origin, and destination could be used to justify attacks – means that this has not been clear in many cases when vessels have been attacked and the threat posed by the Houthis should therefore be considered as applying to all vessels transiting the Gulf of Aden and Red Sea. Most attacks have so far occurred in the Red Sea off Yemen and vessels in these waters should be considered as facing the highest risk. However, attacks have been recorded elsewhere on a more sporadic basis, which, combined with the capabilities of the Houthis, results in a geographically widespread threat.

Outlook

At present, the most likely scenarios that would see a substantial reduction in the Houthi threat facing shipping would include a settlement to the Israel-Hamas conflict, or effective airstrikes by the US and its allies that successfully degrade the Houthis’ capabilities to the point where they are unable or unwilling to continue targeting shipping.

Recent developments in the Israel-Hamas conflict signal a ceasefire will not be forthcoming and that an Israeli military occupation of the Gaza Strip looks evermore likely. Israeli President Benjamin Netanyahu has reportedly refused to agree to a deal that entails the large-scale release of Palestinian prisoners held in Israel. The status of hostages remains a key issue for both sides and Hamas has also, in recent days, reportedly rejected a framework for a hostage deal that had been agreed to by Israel, saying it would not accept any agreement that did not include an end to the war and the withdrawal of all Israeli troops. Given Houthi assertions that they will continue to support the people in the Gaza Strip until “the end of the siege, the entry of food and medicine”, it is highly unlikely that these conditions will therefore be met in the near-term16.

Military action by the US and its allies under the auspices of Operation Prosperity Guardian also appears unlikely to prompt a cessation of attacks in the coming weeks or months. Despite US officials purportedly claiming that around 20-30% of the Houthis’ offensive capabilities had been degraded as the result of the initial round of US and UK airstrikes, the group have continued to launch their attacks in the weeks since17. While it is impossible to accurately assess the Houthis’ weapons holdings, the group has previously survived years of Saudi-led airstrikes and is highly likely adept at dispersing and concealing its assets.

Moreover, even if US-led airstrikes are successful in destroying much of the Houthis’ most capable and sophisticated weaponry – such as anti-shipping ballistic and cruise missiles – the group still possess an arsenal of lower-tier platforms, such as relatively low-cost drones, that would likely allow them to maintain a credible threat to shipping. Moreover, the Houthis’ main backer, Iran, is expected to continue arming them with many of the weapon systems they have long relied on.

In addition to these visible triggers for a de-escalation, it cannot be ruled out that the Houthis will ease their attacks in response to their ongoing negotiations with Saudi Arabia. While the Houthis have publicly stated ongoing hostilities against Israel and the US have no bearing on the talks, Saudi Arabia may provide incentives for the Houthis to deescalate hostilities. Indeed, Saudi Arabia are known to have called on the US to work towards ending hostilities in Gaza, demonstrating their desire to stabilise the situation.

While all sides in the conflict, including Iran, are almost certainly attempting to operate below a threshold that would result in a significant escalation in the region, a combination of heightened tensions and militarisation in the region do increase the probability of an escalation through miscalculation. The US is, for example, yet to respond to an attack against a military bases in Jordan, suspected of having been conducted by Iran-backed Iraqi militant group, that killed three of its personnel and injured dozens. While scores of attacks have been launched at US military bases in the region since November 2023, the consequences of this attack – intended or not – risks triggering an escalatory cycle of attacks, depending on how the US reacts. Similarly, any further attacks – including against shipping – that cause notable losses, should be considered as potential flashpoints that could further curtail shipping in the Bab al-Mandeb – and potentially the Strait of Hormuz in the event of a conflict with Iran – facing an even more acute threat.

- https://www.mei.edu/publications/irgc-admits-aiding-houthis-against-saudi-led-coalition-yemen ↩︎

- https://www.aljazeera.com/news/2022/2/3/timeline-uae-drone-missile-attacks-houthis-yemen ↩︎

- https://www.crisisgroup.org/middle-east-north-africa/gulf-and-arabian-peninsula/yemen/catching-back-channel-peace-talks-yemen ↩︎

- https://www.aljazeera.com/features/2023/11/2/analysis-houthis-declare-war-on-israel-but-their-real-target-is-elsewhere ↩︎

- https://www.fdd.org/uncategorized/2023/12/14/yemens-iranian-backed-houthis-go-all-out-supporting-hamas-and-war/ ↩︎

- https://maritime-executive.com/article/hijacked-car-carrier-s-crew-treated-as-well-as-can-be-expected ↩︎

- https://www.barrons.com/news/eighteen-shipping-companies-re-routing-around-africa-amid-red-sea-attacks-un-e305122d ↩︎

- https://www.wsj.com/business/logistics/shipping-panama-red-sea-suez-canal-edc91172 ↩︎

- https://www.reuters.com/business/autos-transportation/tesla-berlin-suspend-most-production-two-weeks-over-red-sea-supply-gap-2024-01-11/ ↩︎

- https://www.bloomberg.com/news/articles/2023-12-20/shipping-insurance-for-red-sea-transit-soars-as-attacks-persist ↩︎

- https://www.supplychaindive.com/news/shipping-lines-divert-ships-suez-canal-red-sea-cargo-ship-attacks/702824/ ↩︎

- https://www.reuters.com/world/middle-east/us-british-forces-carry-out-additional-strikes-against-houthis-yemen-2024-02-24/ ↩︎

- https://www.theguardian.com/us-news/2023/dec/19/us-announces-naval-coalition-to-defend-red-sea-shipping-from-houthi-attacks ↩︎

- https://www.bbc.co.uk/news/world-middle-east-68110358 ↩︎

- https://www.bbc.co.uk/news/world-middle-east-68162927 ↩︎

- https://www.reuters.com/world/middle-east/joint-patrols-guard-ships-response-attacks-by-houthis-backing-palestinians-2023-12-18/ ↩︎

- https://www.nytimes.com/2024/01/13/us/politics/houthis-yemen-us-airstrikes.html ↩︎

Contact Us

Leading SCR and Alert:24’s Security Risk Analyst team, Carl oversees the intelligence and analytical elements to client services.

Carl served eight-years in the British Army Intelligence Corps prior to joining Alert:24 as an Operations Centre Consultant in June 2013. Progressing through the business and gaining corporate experience, he now manages our team of analysts, providing a wide range of Risk Advisory services to our diverse client base. Carl also has a BSc (Hons) in Design Technology.