Global Piracy Trends: 2023

2023 has been a significant year for maritime developments, with a range of incidents both reinforcing existing trends facing the commercial shipping sector and underscoring the industry’s vulnerability to significant geopolitical events.

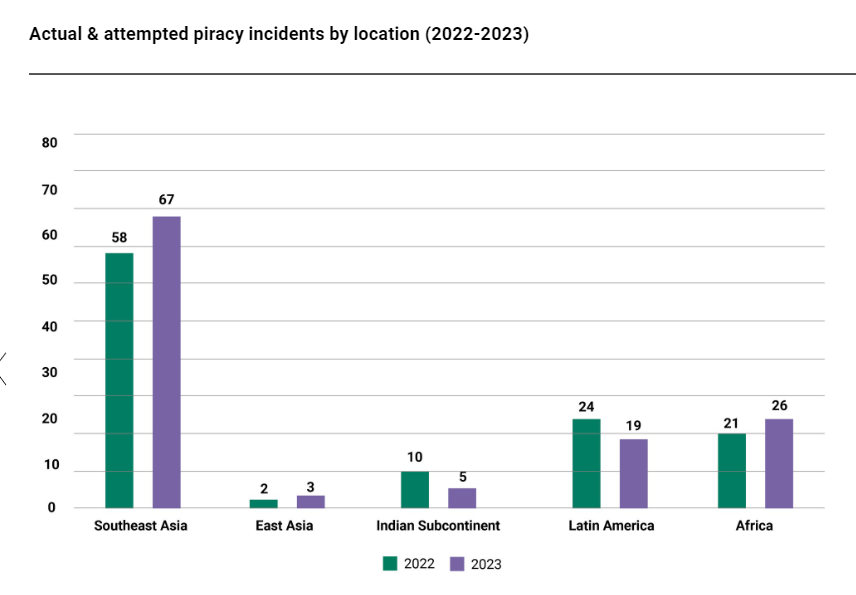

Piracy has remained a major and consistent concern throughout the year – as will be explored in more detail below – with armed criminals threatening commercial vessels both at anchorage and while at sea. In 2023, the International Maritime Bureau (IMB) Piracy Reporting Centre recorded a total of 120 instances of piracy and robbery at sea, up 4.35% from the 2022 figure of 115. Despite the small increase witnessed this year, this is assessed to be in line with existing trends, as reported maritime piracy incidents have overall been on the decline globally over the past six years, despite the minor uptick seen in 2020 which bucked the trend.

Insured perils

-

Extortion (Cyber)

-

Hijack/Piracy

-

Illegal Seizure

-

Kidnap

-

Vessel Boarding

The Fundamentals of a Special Crime Piracy Policy

Special Crime insurance works on a reimbursement basis and offers unlimited cover for the fees and expenses of a crisis response provider.

01

24/7 worldwide coverage and dedicated crisis response provider

02

Strictly confidential policy

03

Declarations are commonly required for breach transits of the Listed Area

04

No deductibles

05

Potential for No Claims Bonus

06

Can include a bursary that can be used to mitigate the risks you are insuring against

Our offering is flexible to fit your organisation's requirements and exposures

Single Transit Policies

Considered a more flexible option, with transit premiums being charged for as and when they occur.

Last-minute transits require formal requests for underwriter quotation and cover cannot be automatically granted.

Cover is only available for High Risk Areas (HRA) and is not available worldwide.

Annual Policy with Monthly or Quarterly Declarations

Premium is paid in monthly or quarterly declarations, instead of upfront.

If a vessel is on the Schedule, all transits are covered automatically by the policy.

This policy is ideally suited for clients with a large number of HRA requirements.

There is the option of a No Claims Bonus.

Prepaid Premium for Block of Transits/Rotations

Considered the least administrative burden, this policy allows for worldwide coverage. If the end of the policy period nears and transits remain, the policy can be extended until the transits are used. This is particularly useful for clients who know their routes in advance, and is suitable for vessels on rotations.

There is the option of No Claims Bonus.

How we define insured persons:

Masters, officers, and crew of the insured vessel, and any supernumeraries and any person legally on board the insured vessel with the permission of the Insured and/or the Insured Vessels' master.

Insured losses

-

Ransom

-

Personal Accident

-

Ransom in Transit

-

Legal Liability

-

Additional Expenses

-

Loss of Hire

-

Unlimited Response Advice & Support

What we bring

Detailed product knowledge

We are a centre of excellence for Special Crime insurance including Maritime Piracy, providing wording expertise and innovative new products, including enhanced Loss of Hire via our dedicated Piracy team.

20+ years experience in handling piracy claims

We have extensive experience in dealing with highly sensitive Piracy cases across the Gulf of Aden and the Gulf of Guinea. We gained enormous experience in the height of the Somali piracy crisis, and were responsible for key changes to market wordings for these risks.

Significant market share

We leverage our insurer relationships and are able to provide our clients with very competitive insurance programs, with regards to price and coverage.

360 degree support

Our Alert:24 crisis support and risk advisory service is available 24/7, managing and supporting clients at the point of an incident, throughout the claims process and beyond.

Vetted response providers

We remain the only insurance broker in the world to regularly audit the expertise and capabilities of the insurers’ third-party response provider.

Intelligence services

Our online portal provides access to a range of intelligence, whilst our clients benefit from quarterly risk reviews, as well as regular and bespoke analysis.

Bespoke programme design

Our policies are flexible and are tailored to each individudal clients’ needs.

What happens if your organisation faces a crisis?

Our Alert:24 team are on-hand 24/7

We provide comprehensive assistance in times of crisis to you, acting as your single point of contact to allow expert management and control of crises.